After the FY21 year-end result of CL Educate, we wrote in June’21: In fact, when it looks back at FY21 many years later, it may find that it was a key turning point in its corporate journey.

Then after Q1 FY22 results, we wrote in Aug’21: After 2 years – FY20 and FY21 – of hanging tough, CL Educate appears to have entered a cycle of positive developments from FY22. Q1 FY22 results showed early indications of this.

Now, FY22 half gone, what we have been saying for a few months is visible: both in reported results, and in stock market performance.

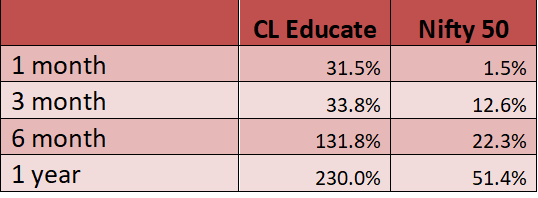

Let’s first look at the market performance:

CL Educate’s Share Price Returns Versus Nifty

CL Educate is handily outperforming the market. Its re-rating journey took off from May’21, from where it has more than doubled, compared to a 22% rise in the Nifty.

The Q2 results have several positives, indicating that the re-rating journey has more legs.

Sales growth momentum improved in Q2 FY22, alongwith good improvement in EBITDA margins and net profits. Some result highlights:

At the consolidated level

- Revenue for Q2 FY22is up 16% over Q2 FY21. The yoy growth is better than in Q1 FY 22, where revenue had grown 10% over Q1 FY21. In other words, there is improvement in revenue growth as Covid impact reduced.

- Revenue for H1 FY22 is up 13% over H1 FY21.

- The operating EBITDA margin (earnings before interest, tax, depreciation and amortization, excluding other income) for Q2 FY22 was 13.6%, the highest ever quarterly EBITDA margin since CL Educate got listed in 2017.

- The operating EBITDA margin for H1 FY22 was 12.8%, as against 4.3% for H1FY21

- As mentioned earlier, CL Educate’s EBITA margin has undergone a structural change post Covid due to increased digitalisation of business

- In value terms, the operating EBITDA was Rs 13.5 crore and total EBITDA (including other income) was Rs 15 crore for H1FY22. In contract, for H1 FY21, the operating EBITDA was Rs 4 crore, while total EBITDA was Rs 9 crore. In other words, the quality of earnings has improved in FY22

Segments

- The Test Prep or the Career Launcher business has shown 22% growth in revenues for Q2 FY22, while Enterprise or Kestone business has shown 10% revenue growth in Q2 FY22

- Q2 was less affected by Covid, hence there was greater improvement in Career Launcher revenue. The Kestone business is likely to start witnessing positive impact of receding Covid from Q3 and Q4.

- The Kestone business is launching more variants of its Virtual Event Platform (VEP). From webinars, the VEP has variants, currently at testing stage, that can also handle group video calls with much better features compared to Zoom or Webex. Another variant is Do-It-Yourself (DIY) variant for managing events. With these digital platforms in its armoury, Kestone is now a vastly differentiated business compared to other local contenders in the experiential marketing space. In fact, the management is quite positive on being able to carve out an international niche for itself in this space.

- For H1 FY22 the Test Prep or the Career Launcher business has shown 17% growth over H1 FY21. The Enterprise or Kestone business has shown 11% growth.

Balance Sheet

- The total debt reduced to Rs 39.5 crore as on 30-Sep-21, as compared to Rs 42.9 crore as on 31-Mar-21.

- Net cash (Total Cash and Cash Equivalents less total debt) increased to Rs 34 crore as on 30-Sep-21, as compared to Rs 26 crore as on 31-Mar-21.

Wisdomsmith’s Investor Relations team (WISDOM IR) advises CL Educate on Investor Relations.