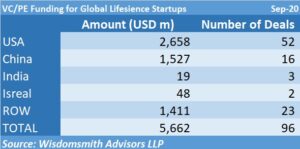

We recorded 96 VC/PE transactions pertaining to the global life sciences sector for Sep 2020, aggregating to a sum of USD 5.6B.

USA recorded 52 transactions for with total investment of USD 2.6B. China reported investment of USD 1.5B over 16 VC/PE transactions.

China also reported 2 IPOs aggregating to a fundraise of USD1.1B, and 11 cross border transactions involving in/out licensing deals and other forms of research partnerships.

Key Venture Capital transactions

Bright Health, USA (USD 500m), Series E

Insurance startup Bright Health raised another $500 million in a Series E round led by Tiger Global Management, T Rowe Price and Blackstone. The company, which was co-founded in 2015 offers individual market plans and Medicare Advantage plans.

BioNTech, Germany (USD 445m), Covid Support

BioNTech SE has been promised a grant of up to 375 million Euro from an initiative by the German Federal Ministry of Education and Research (BMBF) to support the accelerated development of SARS-CoV-2 vaccines. BioNTech will use the milestone-based BMBF funding to support its contribution to the Company’s mRNA vaccine program BNT162 that is being co-developed with its partners Pfizer Inc. and Fosun Pharma respectively.

The Company has already achieved five of the eight defined milestones. Most recently, BioNTech received approval from the German regulatory authority, the Paul-Ehrlich-Institut, to initiate the German arm of the global Phase 2/3 trial. Patient recruitment has commenced on three continents and over 28,000 participants have already been enrolled worldwide with study sites in the United States, Brazil, Argentina and Europe. Potential marketing authorisation is dependent on the final outcome of the ongoing late-stage clinical trials.

XtalPi , China (USD 319m), Series C

XtalPi is an American-Chinese biotech firm that focuses on AI-assisted drug discovery. It has raised a $319 million round C from a slate of investors led by SoftBank’s Vision Fund.

This company, founded in 2014, purports to offer extremely low-level simulation and prediction of target molecules, both simulating the physics at atomic levels and doing the more traditional data science work that eliminates dead ends and points towards more fruitful avenues for investigation.

CureVac, Germany (USD 299m), Covid Support

CureVac N.V. (Nasdaq: CVAC), a biopharmaceutical company developing a new class of transformative medicines based on messenger ribonucleic acid (mRNA) in clinical trials, has received notification from the German Federal Ministry of Education and Research (BMBF) that CureVac is expected receive up to 252 million euros to support the development of its COVID-19 vaccine candidate. In July 2020, CureVac had applied to a grant as part of a special program to accelerate the research and development of urgently needed vaccines against SARS-CoV-2.

Shenzhen Salubris Pharma, China (USD 260m), PIPE

Carlyle Group is investing USD260m for a 5% stake in Salubris.

Shenzhen Salubris Pharmaceuticals Co., Ltd. (Salubris) is a publicly traded, fully integrated pharmaceutical company [002294:CH]. Founded in 1998, Salubris has grown to achieve sales of >$750M USD in 2017 (based on 2017 exchange rates). Salubris is headquartered in Shenzhen, China, and has over 4,000 employees working across R&D, regulatory, marketing and sales. Salubris’ marketed and pipeline products include drugs and devices in the cardiovascular, oncology and anti-infective therapeutic areas.