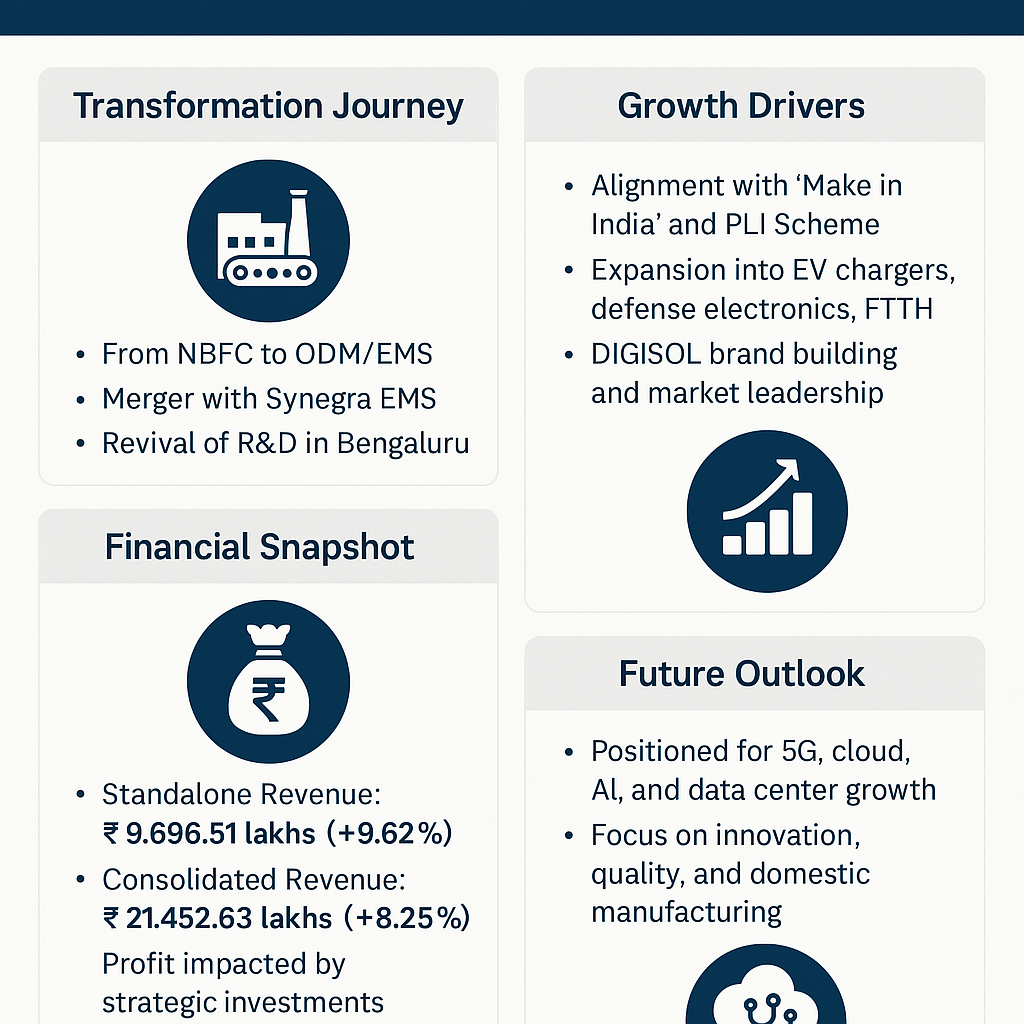

Smartlink Holdings Limited has entered a transformative phase in its corporate journey, says its Annual Report for the financial year 2024–25. The company, once operating as a Non-Banking Financial Company (NBFC), has now repositioned itself as a full-fledged Original Design Manufacturer (ODM) and Electronics Manufacturing Services (EMS) provider. This strategic pivot marks a significant milestone, aligning Smartlink with India’s broader industrial vision and the government’s push for self-reliant manufacturing.

Lets step back a bit to look at the history of Smartlink. The company was operating as a holding company for more than a decade, after its separation from Taiwan’s leading IT peripheral maker D-Link. Smartlink Holdings Limited exited its D-Link business in the year 2009. This strategic move involved the demerger of its D-Link operations, after which the company changed its name from D-Link (India) Limited to Smartlink Network Systems Limited on June 10, 2009.

Following the exit, Smartlink retained its manufacturing capabilities and launched its own indigenous brand, DIGISOL in Aug’16, to continue in the networking products space. This was, and continues to be, housed in a subsidiary DIGISOL Systems Limited. The exit from D-Link allowed Smartlink to avoid potential conflicts of interest and competition concerns, especially since D-Link Taiwan was expanding its direct presence in India.

Smartlink also launched another subsidiary Synegra EMS Limited, in Dec’16. This company focuses on the ODM and EMS business mentioned above. It was merged into the parent in FY25, turning the parent into an operating company after many years of being an NBFC Holdco.

This move not only streamlines operations but also allowed Smartlink to consolidate its manufacturing and R&D capabilities under one roof. With this integration, Smartlink has ceased its NBFC operations and surrendered its registration to the Reserve Bank of India, signaling a clear commitment to its new identity.

A key highlight of the year was the revival of Smartlink’s R&D operations in Bengaluru, after a hiatus of 15 years. This renewed focus on innovation is expected to drive the development of advanced networking products, including software for network switches and FTTH (Fiber to the Home) solutions. The company’s manufacturing facility in Goa, which has long been a cornerstone of its operations, continues to serve as a hub for producing a wide range of products—from structured cabling systems and telecom equipment to EV chargers and defense electronics.

Smartlink’s strategic direction is closely aligned with the Indian government’s “Make in India” initiative and the Production Linked Incentive (PLI) scheme. The management has expressed strong support for policies that encourage domestic manufacturing and reduce reliance on imports. These initiatives have not only created a favorable environment for Smartlink’s growth but have also reinforced its role in building a competitive and self-sustaining electronics ecosystem in India.

The company’s subsidiary, Digisol Systems Limited, plays a crucial role in this vision. As India’s first indigenous IT networking brand, Digisol has made significant contributions across sectors such as smart cities, education, healthcare, and telecom. With a robust portfolio of FTTH, Wi-Fi, switching, and structured cabling products, Digisol is focused on brand-building through loyalty programs, technical training, and strategic partnerships. The management remains confident in Digisol’s potential to emerge as a market leader in the Indian networking space.

Despite a challenging economic environment, Smartlink reported a steady increase in revenue. On a standalone basis, revenue from operations grew by 9.62% to ₹9,696.51 lakhs, while consolidated revenue rose by 8.25% to ₹21,452.63 lakhs. However, profitability was impacted by higher product development and legal expenses, with standalone profit after tax declining to ₹253.68 lakhs from ₹730.51 lakhs in the previous year. The management attributes this dip to strategic investments in future growth and innovation.

Looking ahead, Smartlink is poised to capitalize on the rapid evolution of India’s networking industry. The rollout of 5G, expansion of data centers, and increased adoption of cloud services and cybersecurity solutions are expected to drive demand for advanced connectivity infrastructure. Smartlink’s experience, manufacturing capacity, and renewed R&D focus position it well to meet these emerging needs.

While the two businesses, DIGISOL and Synegra, are yet to fully flower, Smartlink offers compelling valuation. Its market cap currently is around Rs 150 crore. As of 31st March 25, the company has Rs 92 crore of investments in liquid mutual funds (and zero debt), giving it an EV of ~Rs 60 crore. At this valuation, there could be little downside.