As the world accelerates toward electrification, the battery landscape is shifting rapidly. Among the various chemistries vying for dominance in lithium-ion batteries, Lithium Iron Phosphate (LFP) has emerged as a strong contender, particularly in electric vehicles (EVs) and stationary storage applications. While the technology is celebrated for its safety, long cycle life, and cost-effectiveness, an often-overlooked aspect is the battery-grade LFP powder that forms the core of its cathode. The making of this material is a highly specialised, niche business, with a limited number of global players capable of producing the material to the stringent standards required by cell manufacturers.

LFP Powder: The Heart of the Cathode

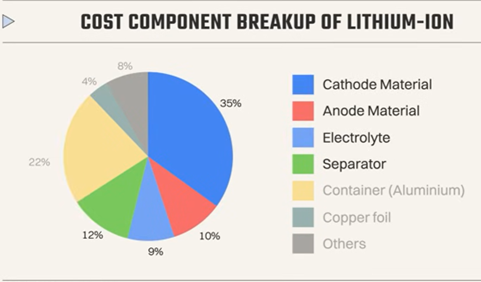

In lithium-ion batteries, the cathode constitutes the largest single cost component, often accounting for around 40% of the total battery cost. Within the cathode, the active material — the battery-grade LFP powder — represents the majority of this cost. The quality, uniformity, and consistency of this powder directly influence the battery’s performance, cycle life, and safety.

Unlike commodity chemicals, battery-grade LFP powder is not something that can be produced by any manufacturer with basic chemical capabilities. Each particle must meet extremely precise Li:Fe:P stoichiometry, meaning the lithium, iron, and phosphorus atoms must be in an almost exact 1:1:1 ratio — even tiny deviations can lead to inactive impurity phases, lower capacity, and faster degradation, making stoichiometry control one of the most critical aspects of battery-grade LFP powder production. Beyond stoichiometry, the powder is usually carbon-coated to improve conductivity — a process requiring exacting control over coating thickness and uniformity. These factors collectively make the production of battery-grade LFP powder a sophisticated, IP-heavy process, which explains why global supply is concentrated in a small number of specialist companies, primarily based in China.

Emergence of LFP vs NMC and Rising Demand

Historically, Nickel-Manganese-Cobalt (NMC) chemistries dominated high-energy-density applications, especially in premium EV models. However, LFP has increasingly gained market share due to its cost efficiency, thermal stability, safety, and long cycle life.

In India, mainstream EV manufacturers such as Tata Motors, Mahindra, and BYD are deploying LFP batteries in their vehicles, while battery manufacturers like Exide Industries (through its Nexcharge/Svolt JV) are supplying LFP cells for both EVs and stationary storage systems (BESS).

The shift toward LFP naturally drives the demand for battery-grade LFP powder, as it is the critical raw material for cathode production. LFP is not only used in EVs but is increasingly deployed in Battery Energy Storage Systems (BESS), including commercial, industrial, and utility-scale applications. Its safety, long cycle life, and relatively low cost make it the preferred chemistry for large-scale energy storage in India and globally.

As LFP adoption accelerates, the demand for high-quality, large-volume LFP powder is expected to surge. Estimates suggest:

- Global demand for LFP cathode materials is currently around 1.5 million tonnes annually (2025).

- By 2030, this could grow to 2.5–3 million tonnes annually, reflecting growth in EV adoption as well as utility and commercial BESS deployments, where LFP is the preferred chemistry.

Within India, while EV penetration is still modest, the passenger EV market is rapidly expanding, and LFP batteries are increasingly being deployed in stationary energy storage systems (BESS) as well. LFP now constitutes the majority of cathode chemistry in both mainstream EV models and commercial/utility-scale storage solutions. This makes India not only a significant consumer but also a potential export hub for LFP powder and cathode materials, particularly as manufacturers scale up production in domestic giga factories.

India’s Giga Factory Boom: Triggering LFP Powder Demand

Several major Indian industrial players are now investing heavily in gigafactories, positioning the country as a regional and global hub for battery manufacturing:

- Reliance Industries: Announced multi-gigawatt battery complexes for both EV and stationary storage, with strong focus on exports.

- Exide Industries (Nexcharge/Svolt JV): Targeting Indian EV OEMs and regional exports with prismatic and cylindrical LFP cells.

- AltMin / other materials players: Focusing on cathode and precursor materials to feed both domestic and export-oriented battery plants.

These giga factories are projected to generate significant demand for battery-grade LFP powders, both for domestic EV production and BESS deployments, as well as exports. As the factories scale, the pressure on reliable, high-quality LFP powder supply will intensify, creating a lucrative opportunity for companies capable of producing this specialised material.

The Role of Technology Transfer and Indian Players

In India, the Advanced Research Centre for Powder Metallurgy and New Materials (ARCI) and similar institutions play a critical role in technology transfer, enabling domestic manufacturers to produce battery-grade LFP powder that meets global quality standards. Coupled with the emergence of private sector metal powder companies, this provides a unique window for India to not only serve its own EV and BESS market but also capture part of the global LFP powder supply chain.

Successful localisation will require:

- Adoption of stringent synthesis protocols to maintain precise Li:Fe:P stoichiometry and carbon coating standards.

- Collaboration with cell manufacturers to qualify batches consistently.

- Investment in scalable production facilities to meet growing demand.

Companies that can bridge the technology and scale gap will be well-positioned to capitalise on this expanding market.

Supply Chain Challenges and China’s Dominance

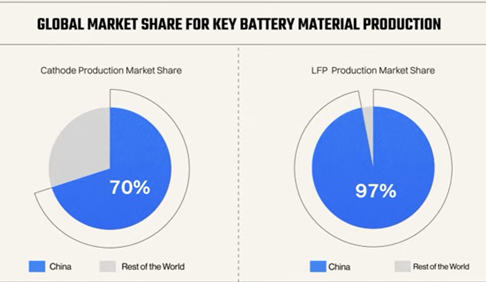

Despite the promising opportunity, the supply chain for battery-grade LFP powder faces notable challenges. China continues to dominate not only LFP powder production but also the upstream raw materials:

- Lithium: Controlled by Chinese players such as Tianqi Lithium, Ganfeng Lithium, and stakes in Australia’s Greenbushes mine.

- Phosphate rock: Controlled largely by Morocco’s OCP Group, with Chinese refiners dominating production.

- Cathode production: ~95%+ of battery-grade LFP powders are made by Chinese companies.

This concentration of supply poses strategic risks for new entrants, as global battery manufacturers are dependent on Chinese sources for both material availability and pricing. Even with domestic giga factories, India will need to secure raw material imports or develop local mines and processing capabilities to ensure supply chain resilience.

Additionally, producing battery-grade LFP powder requires high capex, deep process knowledge, and rigorous quality control, which remains a significant barrier to entry. Companies must also navigate qualification cycles, which can take 12–24 months before a cell manufacturer accepts a new powder source — delaying monetisation even after production starts.

Strategic Implications

Despite these challenges, the niche and high-value nature of battery-grade LFP powder makes it a compelling market for investors and manufacturers. With cathodes forming the largest cost component of a battery, and LFP powder comprising most of the cathode, controlling or supplying high-quality LFP powder directly impacts battery economics and profitability.

The combination of:

- Rapid LFP adoption globally

- Growing Indian EV production and export-oriented giga factories

- Expanding BESS installations in India

- Emerging technology transfer initiatives (ARCI) and private-sector capacity building

…creates a strategic opportunity for Indian companies to enter the global LFP powder market, provided they can overcome technological, logistical, and supply-chain hurdles.

Conclusion

Battery-grade LFP powder is not a commodity — it is a specialised, high-value material critical to the EV and energy storage revolution. Global demand is rising rapidly, with current requirements around 1.5 million tonnes annually, projected to nearly double by 2030. India’s growing EV and BESS market, combined with giga-factory initiatives by Reliance, Exide, AltMin, and others, will trigger substantial domestic and export-oriented demand for this material.

While the opportunity is significant, the supply chain challenges are real, dominated by China’s control over lithium and phosphate resources and the technical complexity of LFP powder production. Indian initiatives like ARCI’s technology transfer programs and the rise of capable private-sector metal powder companies will be pivotal in capturing this market. For investors and industrial players, battery-grade LFP powder represents both a high-value, strategic niche and a gateway to participating in the global EV and energy storage supply chain, provided the technological and operational hurdles can be successfully managed.

The critical role of stoichiometry, carbon coating, and process consistency underscores why this is a highly specialised business with limited global players, making early investment and capability development in India a strategically timed opportunity.

#LFP #BatteryGradeLFP #EVBatteries #LithiumIronPhosphate #CathodeMaterials #BESS #EnergyStorage #EVIndia #BatteryManufacturing #GigaFactory #CleanEnergy #SustainableMobility #LiFePO4 #EVSupplyChain #BatteryTechnology #ARCI #IndianManufacturing #BatteryMaterials #InvestmentOpportunity #GlobalEVMarket #StationaryStorage #InnometAdvancedMaterials #Innomet #AdvancedMaterials