For decades, paneer quietly sat on Indian plates—freshly made at home, consumed locally, rarely discussed in boardrooms. But something has changed. Paneer is no longer just a traditional dairy staple; it is fast becoming one of India’s most important protein growth stories.

And the numbers confirm it: paneer is on track to overtake ghee in market share by 2030.

So, who moved the paneer? And why should dairy companies—and investors—pay close attention?

Paneer’s Rise: From Kitchen Staple to Market Leader

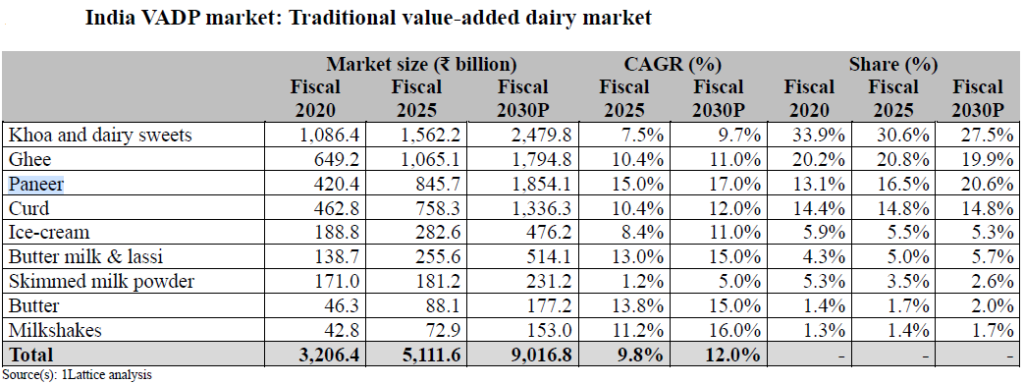

Paneer is expected to command 20.6% market share by 2030, surpassing ghee at 19.9%. This shift is being driven by a robust CAGR of ~17%, making paneer the fastest-growing product within the Traditional Value-Added Dairy Products (VADP) segment.

The underlying driver is clear: protein consumption.

As income level of Indian consumers rise and health-awareness increases, paneer has emerged as a familiar, vegetarian, protein-rich option that fits seamlessly into everyday meals—without requiring a change in food habits.

Organised Market: The Real Growth Engine

While paneer has historically been a largely unorganised product, this is rapidly changing.

- FY25: ~31% of the paneer market is organised

- By 2030: Expected to rise to ~34%

This seemingly modest shift has a powerful impact. The organised paneer segment is projected to grow at ~20.2% CAGR, outpacing the overall category.

Why? Because organised players bring:

- Standardisation and quality assurance

- Wider distribution and cold-chain efficiency

- Brand trust among urban consumers

Urban Lifestyles Are Rewriting Consumption Patterns

One of the most structural shifts aiding paneer’s growth is the decline in home preparation of traditional dairy products.

Busy urban households are increasingly opting for ready-to-consume packaged alternatives rather than making paneer, curd, ghee, or even ice cream at home. Convenience has become as important as tradition.

This trend aligns with broader VADP growth drivers:

- Longer shelf life

- Rising nutrition awareness

- Health-focused consumption

- Time-saving convenience

As a result, consumers are buying paneer—not making it.

Why VADPs Make Sense for Producers

From the producer’s perspective, paneer is not just about volume—it’s about value.

Processing raw milk into VADPs such as paneer, ghee, and ice cream:

- Enhances profit margins

- Improves shelf stability

- Reduces spoilage risks

- Allows better pricing power

This makes paneer an increasingly attractive category for dairy companies looking to move up the value chain.

Exports: A Small but Emerging Opportunity

Paneer exports remain nascent, but momentum is building. Exports are expected to reach ~1.4 thousand tonnes in FY25, supported by steady overseas demand—particularly from Indian diaspora markets.

While exports are still a small part of the overall story, they add an important long-term optionality to the category.

Regional Preferences Tell Their Own Story

Paneer consumption in India is far from uniform:

- North India: ~40%

- West: ~30%

- South: ~20%

- East: ~10%

The strong northern skew reflects deep cultural integration, but the growth runway lies in expanding acceptance across western and southern markets—especially through modern retail and QSR formats.

The RTE Angle: Paneer Beyond the Block

Another fast-emerging theme is Ready-to-Eat (RTE) culinary products featuring paneer dishes such as paneer gravies and chole-paneer combinations.

- FY25: ~9% of the market

- By FY30: Expected to reach ~₹27 billion

- CAGR: ~16%

Paneer is increasingly becoming an ingredient, not just a product—opening doors to higher-margin, branded food segments.

The Bigger Picture

For dairy companies aiming to stay relevant in the next decade, the message is clear:

In fact, it’s not enough to participate—They must crack the paneer business, capture mass market share, outwit competitors, and scale ahead of time.

Success requires:

- Paneer in the traditional VADP segment

- Cheese in the emerging VADP space

Paneer delivers scale, protein relevance, and mass adoption. Cheese brings premiumisation and future growth as well as high margins.

What’s Next?

Paneer may have moved—but cheese is moving even faster.

In the next post, we’ll dive into the evolving dynamics of India’s cheese market:

“Who Moved My Cheese?” – Part II: The Indian Cheese Boom

Stay tuned.

#WhoMovedMyPaneer #PaneerMarket #IndiaProteinStory #ValueAddedDairy #TraditionalVADP #IndianDairy #DairyGrowth #ProteinConsumption #OrganisedDairy #FMCGIndia #FoodIndustryIndia #ReadyToEat #RTEFoods #Amul #MotherDairy #Britannia #HeritageFoods #HatsunAgro #MilkyMist #Dindigul